A suite of solutions to evaluate customers and manage processes using PSD2 data.

WHAT WE DO

CUSTOMER EVALUATION

Evaluating customers doesn’t have to take up a lot of time. A fast response is good for both the business and the customer.

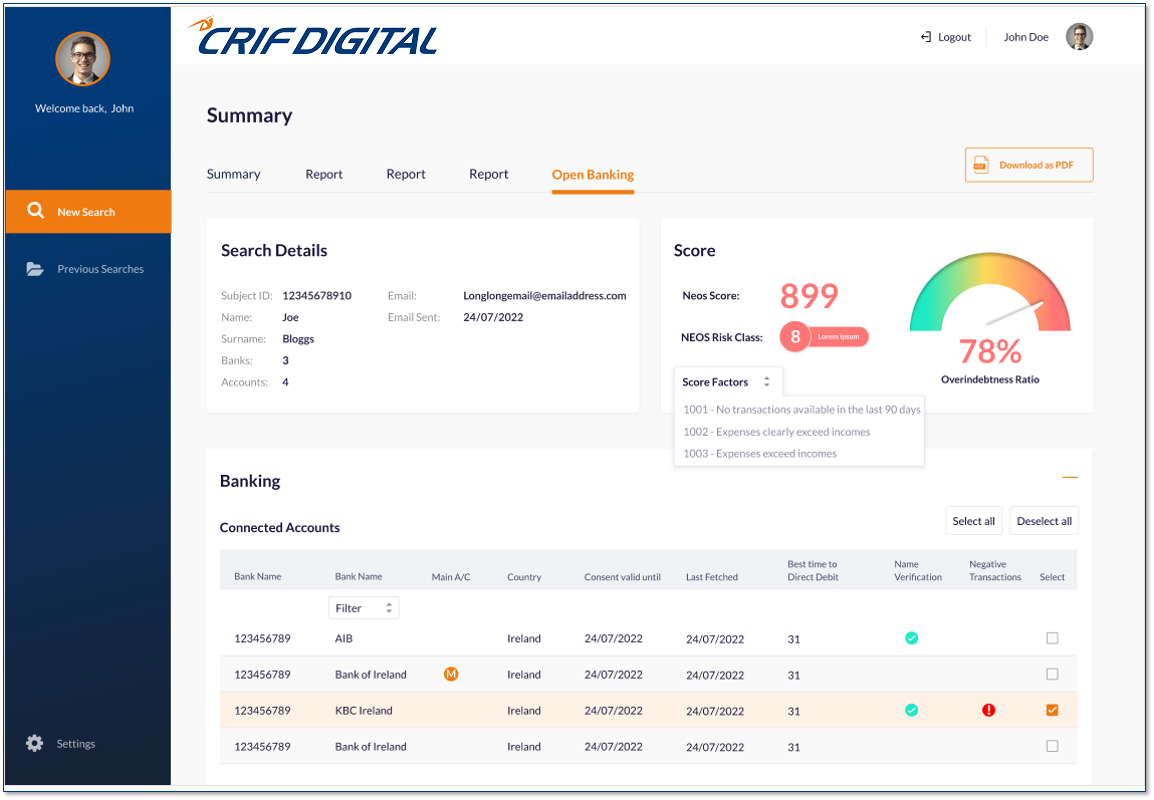

The opportunities generated by PSD2 need to be exploited, and Access to Accounts, Open Banking Scoring & Financial KPIs and Advanced Analytics can help mitigate risks, accelerate business development, and improve knowledge of customers.

A suite of solutions to evaluate customers and manage processes using PSD2 data.

Gain insights about your customer base by leveraging account and credit card transaction data

The white-label solution that speeds up the process of offering financial products.

Credit Passport allow SMEs to view and improve their business credit score and financial institutions to build the resilience and growth of their SME customers.

An analytical solution to help financial institutions improve their business through a data-driven approach.